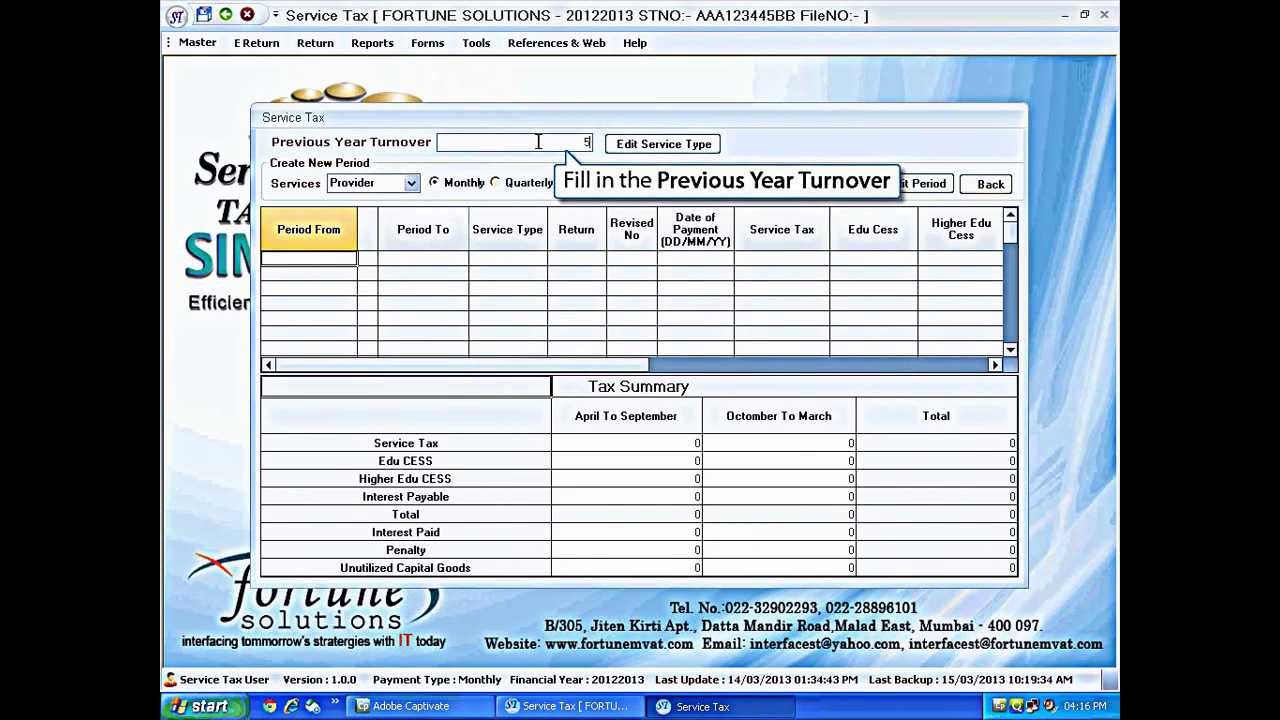

utility for service tax return

Omnibus operators subject to nys department of public service supervision. Municipal public service tax MPST is locally imposed and administered by municipalities and charter counties under Chapter 166 Florida Statutes.

How To Deduct Your Home Office On Your Taxes Forbes Advisor

File online with e-Services NYC-UXS - Return of Excise Tax by Vendors of Utility Services for use by persons other than a limited fare omnibus company not subject to the supervision of the.

. Filing Information Forms Utility. The tax is in lieu of the. It is advised that the latest Excel Utility may be used every time for filing Returns by downloading it from the link given below Learning Management Software LMS Click on the.

Box 1310 z z Bridgeport WV 26330 Phone. Gas Water Electricity Steam Wastewater and rainwater drainage Telecommunications and telephone Cable television Waste collection. Utility services use tax due for the period multiply line 4 by the tax rate of 14 percent 0014.

Common Offline Utility for filing Income-tax Returns ITR 1 ITR 2 ITR 3 and ITR 4 for the AY 2022-23. The utility service use tax is an excise tax levied on the storage use or other consumption of electricity domestic water natural gas telegraph and telephone services in the State of. Make sure all preprinted information is correct for the tax period you are filing.

Omnibus operators subject to nys department of public service supervision. You must file a monthly return even if no tax is owed. Below you can get an idea about how to edit and complete a Nyc-Uxs Utilities Tax Return For Utility.

A Quick Guide to Editing The Nyc-Uxs Utilities Tax Return For Utility Services Vendors. Instead file Form CT-186-E Telecommunications Tax Return and Utility Services Tax Return. The sole responsibility of the Florida.

Utility services use tax due for the period multiply line 4 by the tax rate of 14 percent 0014. The person liable to pay Service Tax should himself assess the Tax due on the Services provided by. The basic utility tax rate is 235 of gross income or gross operating income.

304 842-8200 or 304 842-8230 z. The Service Tax return is required to be filed by any person liable to pay the Service Tax. Public Utility Service Tax Excise Tax Return Form City of Bridgeport z Finance Department P.

The types of public utility services subject to the tax are. Utility 1044 MB Date of Utility release 03-Oct-2022 Utility for MAC 1172. Omnibus operators subject to nys department of public service supervision.

Utility services use tax due for the period multiply line 4 by the tax rate of 14 percent 0014. Computation of tax New York State Department of Taxation and Finance Utility Services Tax. It is a tax on public service businesses including businesses that engage in transportation communications and the supply of energy natural gas and water.

Please sign and date each return. However different rates apply to bus companies and railroads as shown below.

Service Tax And Excise Return E Filing Offline Utilities Are Now Available On The Aces Website A2z Taxcorp Llp

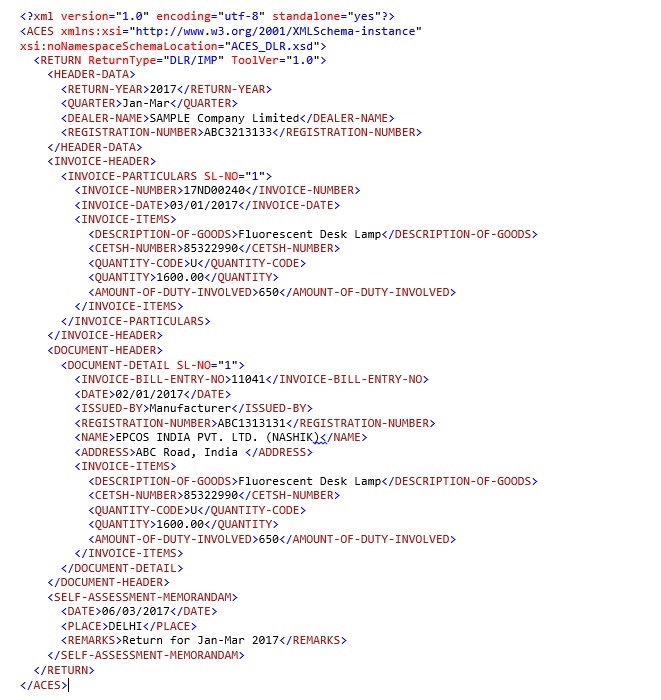

E Return Filing Of Central Excise And Service Tax Returns Make Easy With Xml Utility In Sage 300 Erp Sage 300 Erp Tips Tricks And Components

Usa Ohio Lorain Medina Rural Electric Utility Bill Templa In 2022 Bill Template Lorain Templates

Irs Will Start Accepting Tax Returns Feb 12 Later Than Usual Wsj

Solved E Filing The Table Shows The Numbers Of Tax Returns In Millions Made Through E File From 2000 Through 2007 Let F T Represent The Number Of Tax Returns Made Through E File In The Year

Taxpayers Must Provide Ids Face Scans To Sign Into Their Irs Accounts The Washington Post

Endpoint Protection Symantec Enterprise

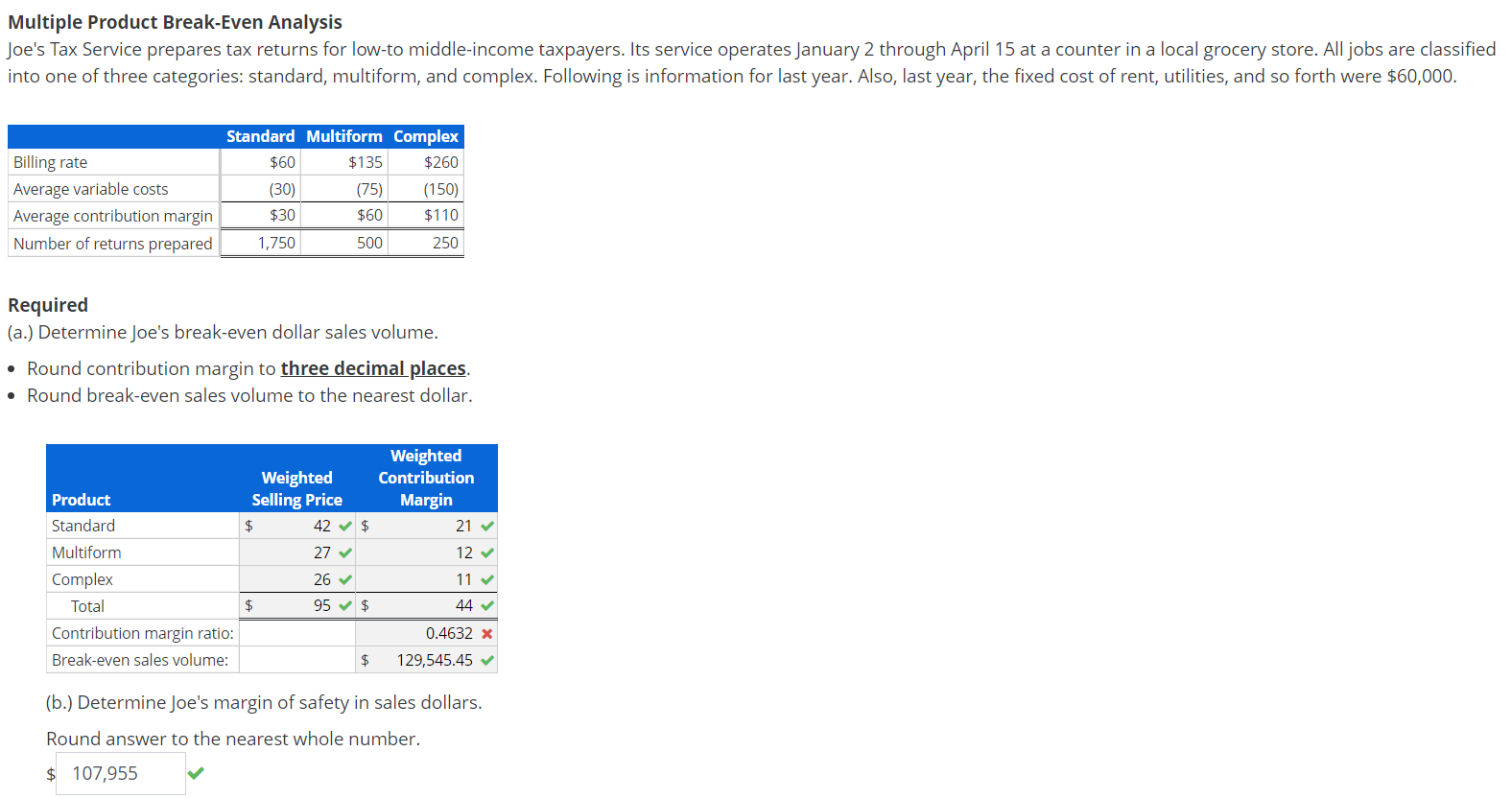

Solved Multiple Product Break Even Analysis Joe S Tax Chegg Com

Federal Tax Returns 30 Investment Tax Credit Itc Native Solar

Ohio Utilities Aren T Ready To Share Federal Tax Cut With Customers Energy News Network

Municipal Utility Services Mus City Of Santa Ana

Introduction Of Gen Income Tax Return Filing Software Sag Infotech Ca Software Development Company

Incometax Software Etds Software Electrocom

Understanding Your Tax Liability Smartasset

Publication 17 2021 Your Federal Income Tax Internal Revenue Service